From the Newsstands: This story appeared in The Eagle's December 2023 print edition. You can find the digital version here.

College students are labeled with many stereotypes: living on ramen noodles, attending every weekend party and surviving on Panera’s Charged Lemonades. Currently, the Biden Administration is focused on fixing “the broke college student” stereotype through student loan forgiveness.

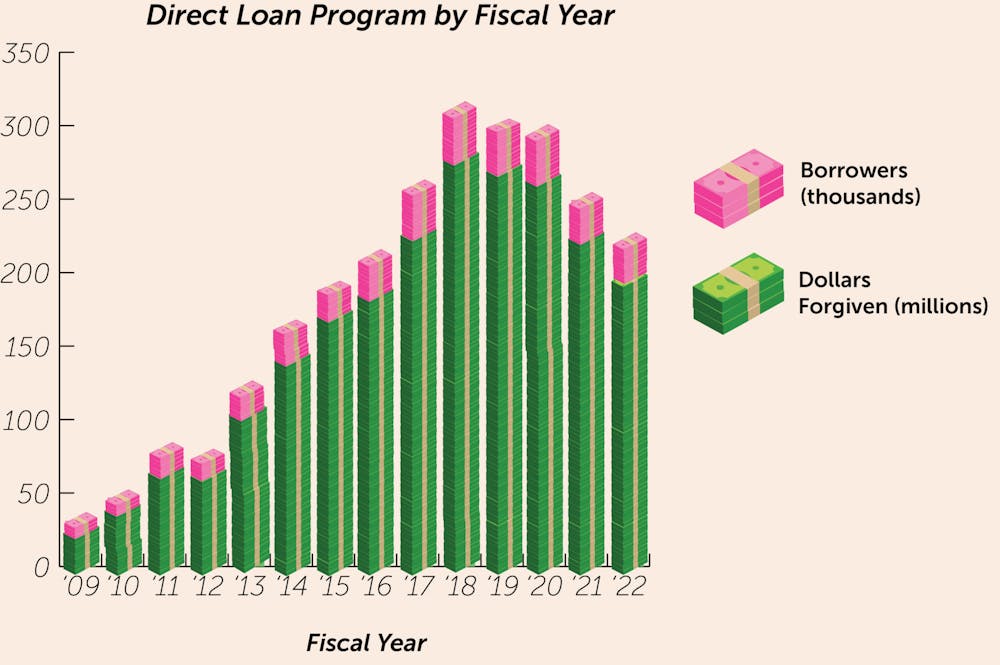

On Oct. 4, President Biden canceled $9 billion in student debt, meaning that this money will be put towards existing federal programs to help those in debt. This comes after the Supreme Court struck down Biden’s original plan that would have eliminated $400 billion in student debt.

Edwin Santos, American University’s student body president and a senior in the School of Public Affairs, said he feels student loan forgiveness will significantly affect students in the long run

What loan forgiveness options do students have?

Santos said that many AU students “go into the public sector” and “the nonprofit world,” due to specified interest in these areas.

Nonprofit and public sector work qualify a student for the Public Service Student Loan Forgiveness Program, one of the most typical ways to apply for forgiveness. Yet, this program is only available after a total of 120 qualifying monthly payments, meaning that it would take at least 10 years before a student can be eligible for PSLF, according to the Department of Education.

In addition to the PSLF, forgiveness programs include Permanent Disability Discharge and the Teacher Loan Forgiveness Program. There are also a variety of federal payment programs for students to apply to, such as Income-Driven Repayment which includes the SAVE, PAYE and IBR plan.

With the Teacher Loan Forgiveness Program, teachers may be eligible for up to $17,500 in forgiven loans if they teach full-time for five complete and consecutive academic years in a low-income elementary school, secondary school or educational service agency, according to the Department of Education. Shayna Caruso, vice president of the School of Education Undergraduate Council and a sophomore in SOE, said that she hopes this program will encourage students to work in low-income school districts.

“There’s not a lot of incentive for teachers to start out in these low-income schools and in these inner city and urban areas because of the high risk that students have,” Caruso said. “I think having this debt cancellation gives just another step for teachers to help out in those areas.”

With the 2024 election looming, student loan forgiveness is threatened by the ever-changing political landscape, which also leaves programs vulnerable and complicates the path to forgiveness.

Understanding loan forgiveness

Santos explained the confusion that students feel, especially due to word choice in these programs, adding that it is a joint obligation of the U.S. government and the University to help students.

“I would say that the local level is the responsibility of the University to be able to make that information digestible and accessible to students,” Santos said.

Yet, as of Nov. 12, the link on AU’s website under “Student Loan Forgiveness,” leads to an outdated Federal Student Aid page about the Biden Administration’s plan that was struck down in June. AU’s Financial Aid Office was unavailable to comment.

The future of student loan forgiveness is still debated today, as the Student Loan Relief Committee was formed by the Department of Education to negotiate student loan

forgiveness rules.

“When you compare the United States to other countries, higher education is incredibly expensive,” Evan Kraft, a senior professorial lecturer in AU’s Department of Economics, said. “And what we see is that that burden, the proportion of that debt to people's income often is highest, so it’s most difficult for minority families. And so it has a really uneven impact in our society.”

This article was edited by Maeve Fishel, Jordan Young and Abigail Pritchard. Copy editing done by Isabelle Kravis, Sarah Clayton and Luna Jinks.